Card as a Service pioneer, Enfuce, introduces MyCard, a physical card product that enables European fintechs to launch their own payment card cost-effectively in just two to four weeks. For fintech companies, this would save months of work from planning, design and card manufacturer integration and speed up go-to-market.

Physical cards remain the number-one payment method in Europe, even as virtual cards and digital wallet payments grow in popularity. Over 600 million physical cards are issued in Europe annually, making them a big source of plastic waste. As demand for physical cards will continue, there’s a need for more sustainable card options. Enfuce’s Card as a Service is a turnkey card issuing service that covers everything from BIN sponsorship and card scheme integration to compliance, fraud prevention and dispute management.

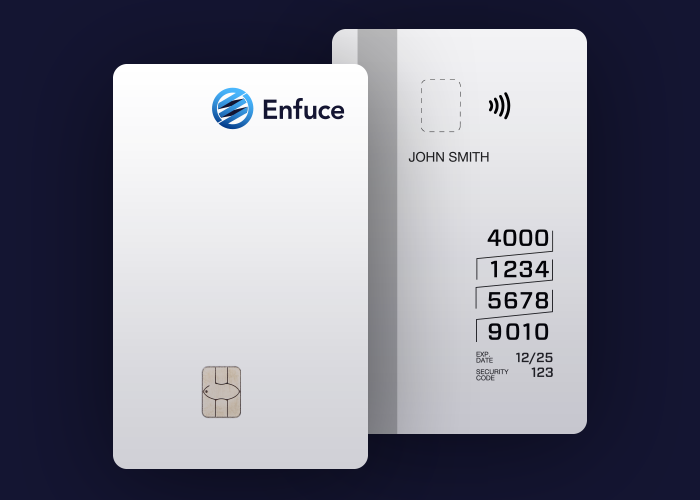

MyCard: Industry-leading speed and customisability

“Thanks to Enfuce MyCard, fintechs can launch winning payment card products with lower risk and capital but also easier and faster than before. MyCard is the first of our 2022 initiatives for accelerating our customers’ time to market, and more will follow”, says Venla Pouru, Enfuce’s Executive Vice President of Strategy and Product.

MyCard offers industry-leading speed to market through Enfuce’s pre-approved design guidelines, pre-made cards and fast delivery across Europe. Customers can define their desired look and feel for the cards, but a design project is not needed. With MyCard, physical cards can be in the hands of cardholders across Europe within the timeline of an initial Card as a Service implementation. MyCard has a transparent and fintech-friendly per-card pricing model, which remains cost-efficient even for smaller batch sizes. MyCard is first launching with Visa*, with the addition of Mastercard later in spring 2022.

Showing the way with more sustainable material options

For customers aspiring to launch a fully-customised physical card, anything is possible with Enfuce’s MyCard offering. MyCard is launching with a wide selection of sustainable card materials to choose from, including recycled PVC, PETG or sea plastics (collected from ocean and coastal regions), and fully renewable materials like corn starch or wood.

“With MyCard, customers will get the benefits of scalable, modern production service with a large variety of personalisation options, from card face to packaging and shipping. Design services help customers to get the products out fast.”, adds Markus Melin, Enfuce’s COO.

*Visa is a registered trademark of Visa International Service Association

Sirpa Nordlund

EVP of Enterprise Sales

[email protected]

+358 40 568 3436

About Enfuce

Enfuce offers payment, open banking and sustainability services to banks, fintechs, financial operators, and merchants. By combining industry expertise, innovative technology and compliance, Enfuce delivers long-term and scalable solutions quickly and securely. Founded in Finland, Enfuce recently expanded its geographic presence in Germany and France and has over 13 million active card users on their platform from whom Enfuce processes close to €1 billion transactions annually.

Enfuce has raised multiple rounds of venture capital funding and has been recognised by e.g. TheFinTech50, Visa Fintech Fast Track programme, Mastercard Lighthouse Development Programme, Deloitte Technology Fast 50, and as winner of the 2019 PayTech Award for “Best Payments solution for Payment Systems in the Cloud”.

For more information, visit www.enfuce.com