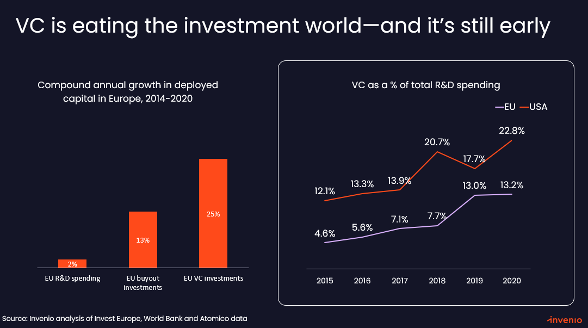

VC is eating the investment world

Companies must innovate to survive—but how can leaders best incubate innovative business lines? By now, most executives know that venture capital (VC) investing presents a compelling alternative to traditional R&D. Whether they’ve read the peer-reviewed reports documenting venture’s ability to outperform other R&D methods, or simply seen the success of a peer’s corporate venture capital (CVC) unit, executives increasingly recognize the power of venture portfolios to effectively foster innovation and drive superior returns.

In short, VC outperforms traditional R&D for two main reasons:

- Discipline. VCs stage-gate their investments based on the real-world growth and develop the professional discipline to cut off companies that fail to meet growth targets. By contrast, traditional R&D tends to drag on since its sponsors benefit more by keeping a project alive and maintaining their budget than they do by admitting failure and shutting it down.

- Diversification. VCs recognize that the best way to achieve optionality is to build a diverse portfolio of highly incentivized risk-seekers. To this end, VC portfolio companies retain decision-making autonomy and large equity incentives that motivate responsible risk-taking. By contrast, traditional R&D managers have limited autonomy; their success is most often measured the by size of their salary or the budget they control—incentives at odds with long-term rewards and diversification.

For these reasons, VC is eating the innovation investment world. According to Invenio research, the amount of venture capital deployed in Europe has grown at a compound annual rate of 25%, or 12x that of traditional R&D spend. Despite this growth, it’s still early days: VC accounted for just 13% of Europe’s R&D spending in 2021, compared to 23% in the US. Corporations are leading the charge: over the last 10 years, CVC’s share of all deployed venture capital rose from 11% to 21%, according to Crunchbase.

An introduction to venture buyouts

Still, for executives at conservative organizations, the question remains: how do I introduce venture investing tools to my business? We’ve spoken to organizations where all investments are strictly monitored. It’s hard enough for them to secure traditional R&D budgets—let alone launch a new venture capability that accepts write-offs as inevitable and requires significant start-up capital.

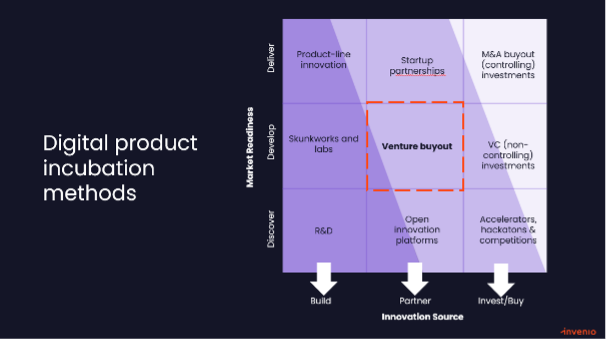

Among the many viable approaches to business line incubation, we focus here on venture buyouts (VBOs), a strategy whereby corporations partner with professional VCs to spin out and scale internal ventures. Unlike a typical incubation effort that requires corporations to put up additional capital and take on more risk, VBOs offer corporations a chance to de-risk early-stage projects and increase the odds of their success. How? By bringing in professional investors who possess the capital discipline and portfolio diversification required to make successful venture bets.

Say an intrapreneur at a bank sees a path to developing a break-through blockchain product, but knows that the risks are too high to fund this project with only bank resources. In the past, this idea would simply die. Today, the intrapreneur can, alongside bank stakeholders, pitch the idea to blockchain-focused VCs with a higher risk appetite. If a VC agrees to invest, the idea starts a new life as a joint venture between the bank and the VC. The bank effectively transfers some of the early-stage risk while retaining long-term optionality. It also gets external validation and expertise to unlock the project’s potential growth. The VC gets access to the frontier asset class of VBOs and strengthens its relationship with a potential strategic buyer.

If, at any point, the project starts to miss the VC’s growth milestones, the VC can cut off funds and advise the corporation to do the same. This external feedback is especially valuable to corporations that tend to keep funding projects for too long—dragged along by sponsors who benefit more from keeping failed projects alive than they do by shutting them down.

How a VBO unlocked value at a listed Swedish company

“We believe the VBO will usher in a new era of partnership with ‘venture builders,’ Nitin Nohria and Hemant Taneja argue in their Harvard Business Review essay on VBOs. Our experience confirms their belief: we’ve seen VBOs unlock incredible value in Europe.

In 2019, we helped a listed Swedish company acquire a fintech. A small part of the acquired fintech didn’t fit our client’s long-term strategy. Worse still, this small business line was losing money. Due to its size and losses, the business line couldn’t be spun off via traditional M&A. Our client’s first instinct was to simply shut it down.

However, we saw a venture buyout opportunity. First, we helped the client reframe the business line as a start-up by bringing in an experienced entrepreneur to vouch for its standalone potential. After sizing the market, analysing the competition, and calculating the capital required to move forward, we concluded that a relatively small investment could result in a billion-euro outcome within six years. While budgetary constraints prevented our client from underwriting the entire investment amount, we were able to identify a VC partner willing to share the risk. As a result of this deal, the valuation of the VBO-spinout saw a significant uplift within three months of the transaction.

Creating a win-win-win

VBOs can easily create win-win-wins for corporations, investors, and newly incentivized intrapreneurs. Still, it’s not always simple. Corporations commonly overvalue what they have built while underestimating the VC firm’s value add. To avoid this problem, we recommend that all sides work with an outside broker who has long-term incentives. Outside professionals who can value VBOs objectively and work across multiple VCs and corporations are better able to ensure a fair and rigorous process.

Venture capital is a compelling alternative to traditional R&D in part because it spreads long-term incentives across a broad range of stakeholders—from the biggest shareholder to the most junior engineer. At their best, VBOs bring an even broader range of stakeholders with even longer-term incentives into the same partnership. As a result, we believe VBOs will become a new standard for corporate innovation investing.

Writer Vincent Weir is a partner at Invenio Growth.

Join Nordic Fintech Summit on March 24th 2022 in Helsinki to hear more about Venture Buyouts from Vincent.