More statistics and numbers can be found on our page Fintech Landscape.

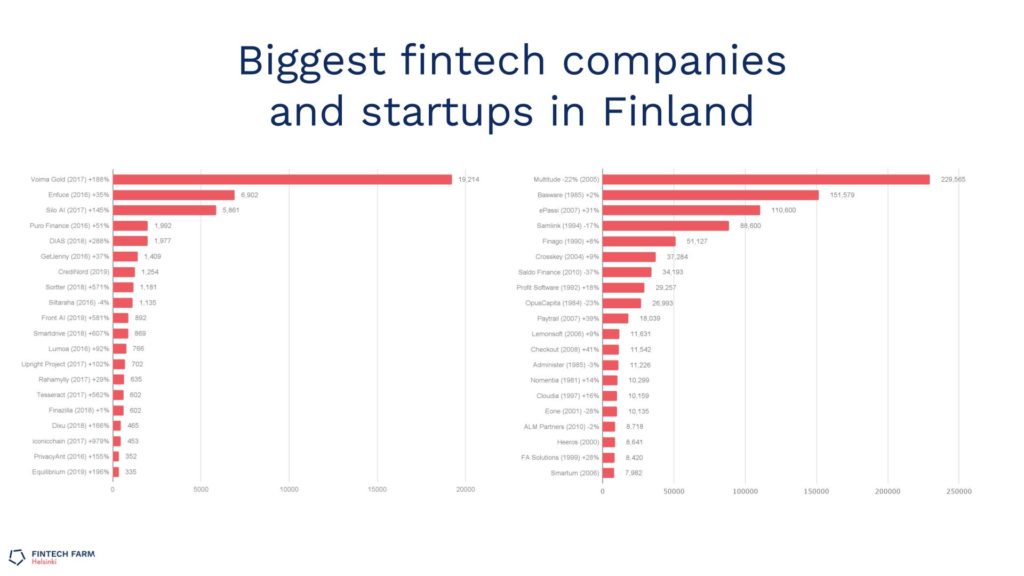

It’s time again to list the Finnish fintech companies by their financials. After scraping together the financial figures from 2020, we have been able to conclude how did the extraordinary year of 2020 treat the fintech companies in Finland.

In brief, the largest and consumer lending-focused companies lost some of their revenues, while the others, especially younger companies grew significantly. This occurred due to the pandemic, which affected negatively a whole lot of companies, especially in the consumer lending industry, due to the temporary interest rate cap of 10%. In total, the industry’s revenue decreased slightly from the previous year’s 1,3 billion euros, which is mainly because some of the biggest companies, such as Multitude’s (previously Ferratum) revenue shrunk has such a big impact on the entire industry.

Our listing relies on official financial statements, which are public information in Finland. Some companies such as Finland’s top-funded fintech AlphaSense is not included, as their overseas revenues are not public knowledge. We have divided the companies into three categories: startups, scaleups and established companies, and listed the top 20 from each.

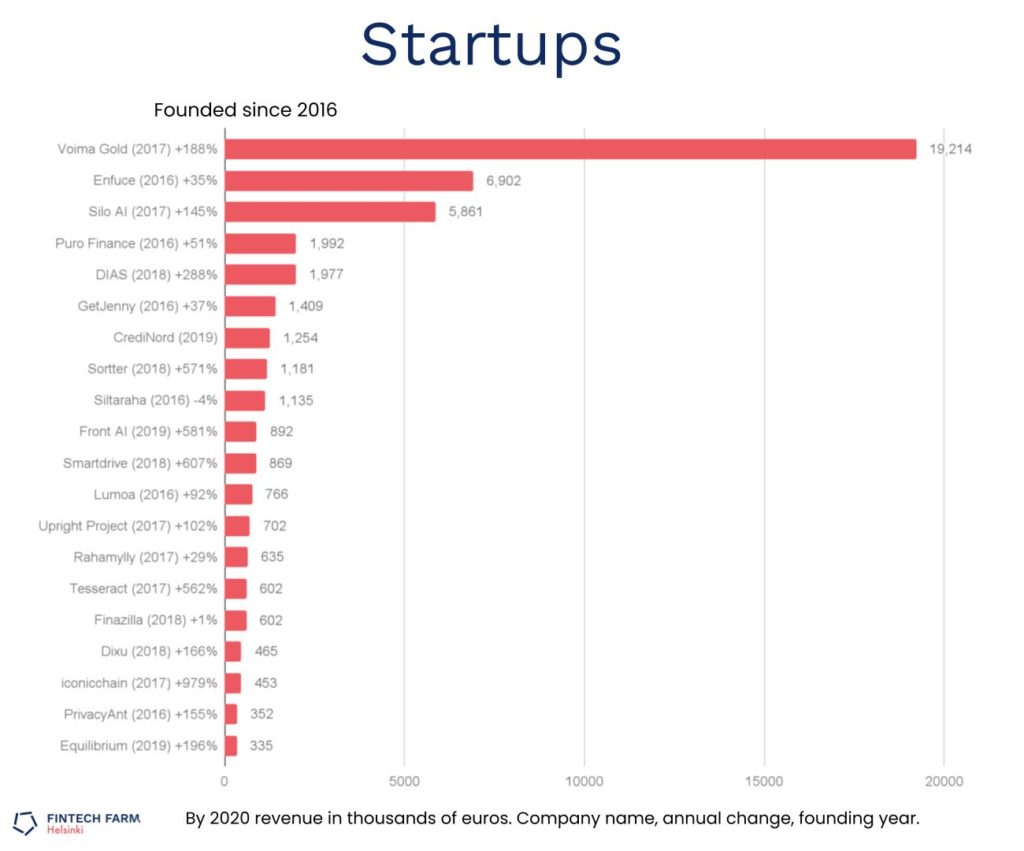

Fintech startups

The startup segment, companies no more than 5 years old, showed some impressive growth, and these startups on the top 20 list, more than doubled their total revenue.

The biggest company in this category is Voima Gold, which combines investing in physical gold, with a digital solution. However, should be mentioned, that their impressive 19 million euro revenue consists of all their investment transactions, while their effective margin rate is at 2,6% and roughly half a million euros.

The second biggest startup is Enfuce, which has been growing steadily their Card as a Service platform and also raised 7 million euros in funding this year.

This list has several companies that multiplied their revenue, and there is even one ten-bagger, iconicchain as 17th, who managed to establish 5 new bank partnerships for their blockchain-based compliance solution. Another company that relies on distributed ledger on this list is DIAS, which is a digital platform for buying and selling homes. Their 4th position shows, that blockchain finally becomes a real, productive thing.

One clear indicator of the great development is that in 2018, a 100 thousand euro revenue was enough for the top 20 list, while now it would require clearly above 300 thousand. In general, platforms and SaaS are the trending business models in this category.

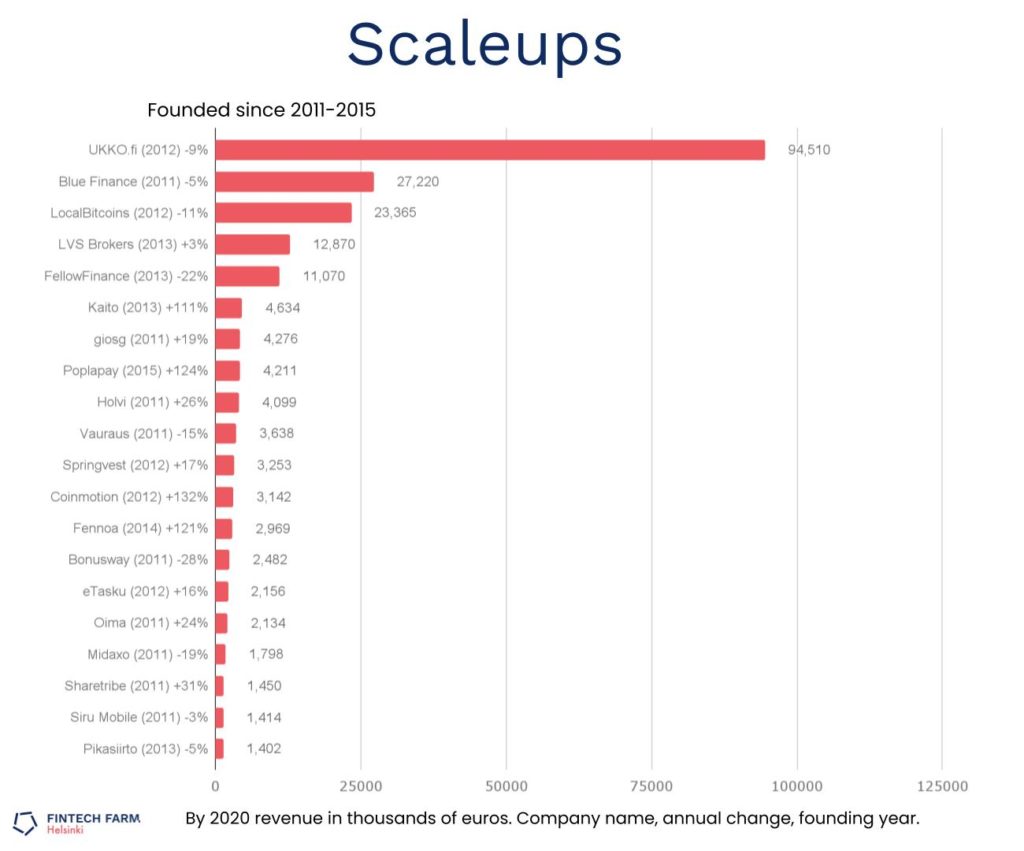

Fintech scaleups

The scaleup category represents 5 to 10-year-old companies, which have already taken their place in the market but still have lots of growth potential.

In this category, the light-entrepreneurship invoicing service UKKO.fi clearly kept their first position, even though their slight drawback in revenue. In this case, should be also mentioned, that they count as revenue, all the salaries transferred through their service.

Companies operating in lending, such as Blue Finance and Fellow FInance clearly suffered from the interest rate cap, and the brokering tech firm LVS Brokers, which is known for its rapid growth, had to settle for a humble 3% growth.

In this category, the real growth engines were the payment solutions provider Poplapay, data analytic company Kaito, crypto exchange Coinmotion and the accounting cloud Fennoa, who all more than doubled their revenue. Transaction-based business models are the most popular among scaleup fintechs in Finland.

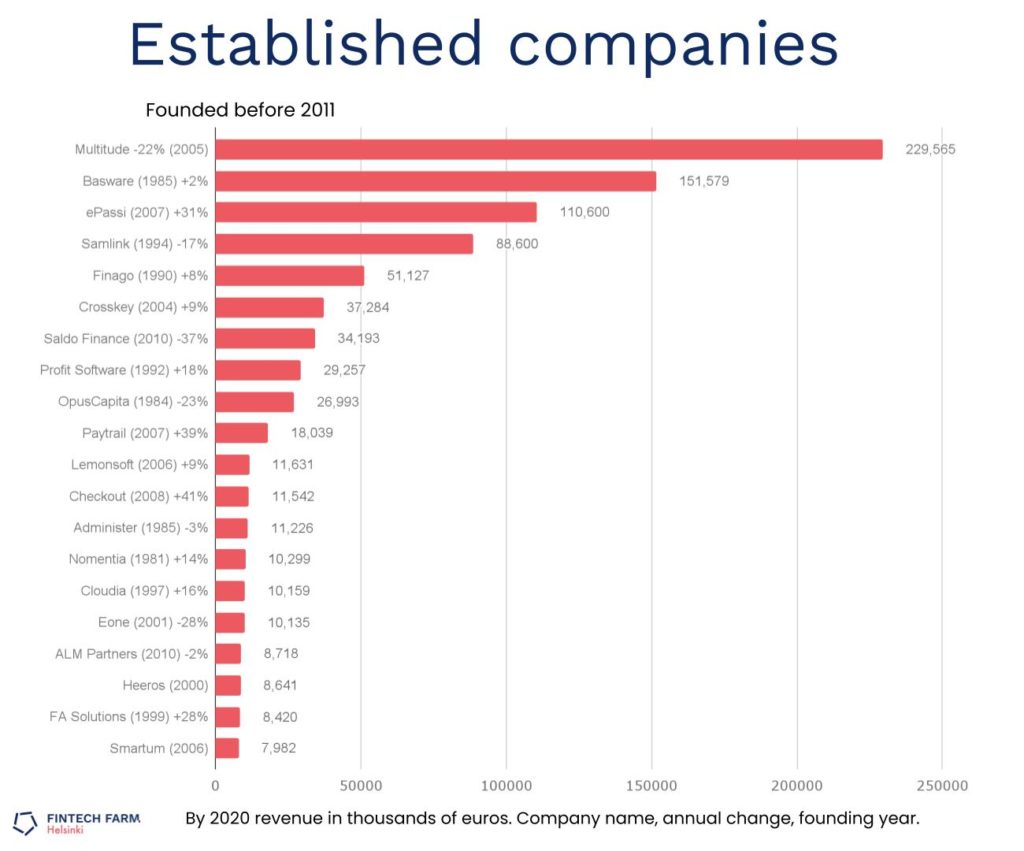

Established fintech companies

This category is representing companies that are over 10 years of age.

The gold position once again is taken by former Ferratum, which was rebranded this year as Multitude SE. Multitude lost more than 60 million of its revenue but is now aiming for new growth, with a new post-pandemic service portfolio, which besides the lending services, has a whole new neobank branch, SweepBank.

On this list there are many financial and accounting technology providers founded already in the last millennium, such as Basware, Samlink and Finago, but also new kind of firms are advancing on the ranking.

Even though the financing firms mainly shrank last year, we do not think that selling money would ever go out of fashion. In this category software is strong, and it can be sold by licenses, as a service or based on transactions.

Like mentioned a few times before. 2020 was special, especially for financing firms, which suffered from the pandemic and the regulation. Generally, it is very positive to see the fast pace of new startups building scalable technology, and getting their first revenue. Many of the companies on these lists have been acquired in the past years, and it is inevitable, that consolidation will also be seen in this field.

Do you want to know anything about the Finnish or Nordic fintech industry? Do you need insights or help with your business? Please get in touch with us.

Fintech Farm

Fintech Farm is a financial technology hub and a digital finance service company connecting banks, fintech companies and service providers. Fintech Farm provides innovation, consulting, acceleration, matchmaking, and training services for the financial industry. Fintech Farm Ltd. is privately held and has built a vibrant community of over 200 financial industry organizations since 2016.

Fintech FarmBase

Do you want to know more about Finnish fintechs? We have an up-to-date database that keeps on growing with over 20 data points. Visit the tasting version at https://www.helsinkifintech.fi/database/ and ask for subscription options to get full access.