More statistics and numbers can be found on our page Fintech Landscape.

Fintech Farm’s annual overview once again ranks Finnish fintech companies based on their financial figures from 2023, providing a comprehensive view of the industry’s development.

The total number of fintech companies in Finland has remained stable at around 210 for some time. While a handful of new entrants appear each year, a similar number exit the market. Some of these companies close down, but consolidation is a significant trend, reflecting the natural evolution of the industry. For example, companies like FabricAI and Poplatek have been acquired by major Nordic players.

When it comes to performance, the focus has shifted from quantity to quality. The total revenue generated by Finnish fintech companies has risen from €1.5 billion to €1.9 billion, a notable increase.

The clear leader remains Epassi, which achieved unicorn status at the end of last year. The company generated an impressive €679 million in revenue in 2023.

AlphaSense took the funding charts to new spheres by securing $650 million in funding. Although AlphaSense is not included in the revenue rankings, it reported €28 million in revenue in Finland in 2023. However, the majority of their revenue comes from their foreign branches, with an estimated annual recurring revenue (ARR) of around $200 million, according to the company’s unofficial figures.

TOP20 Finnish fintech companies in 2023

We have categorized the companies into three groups:

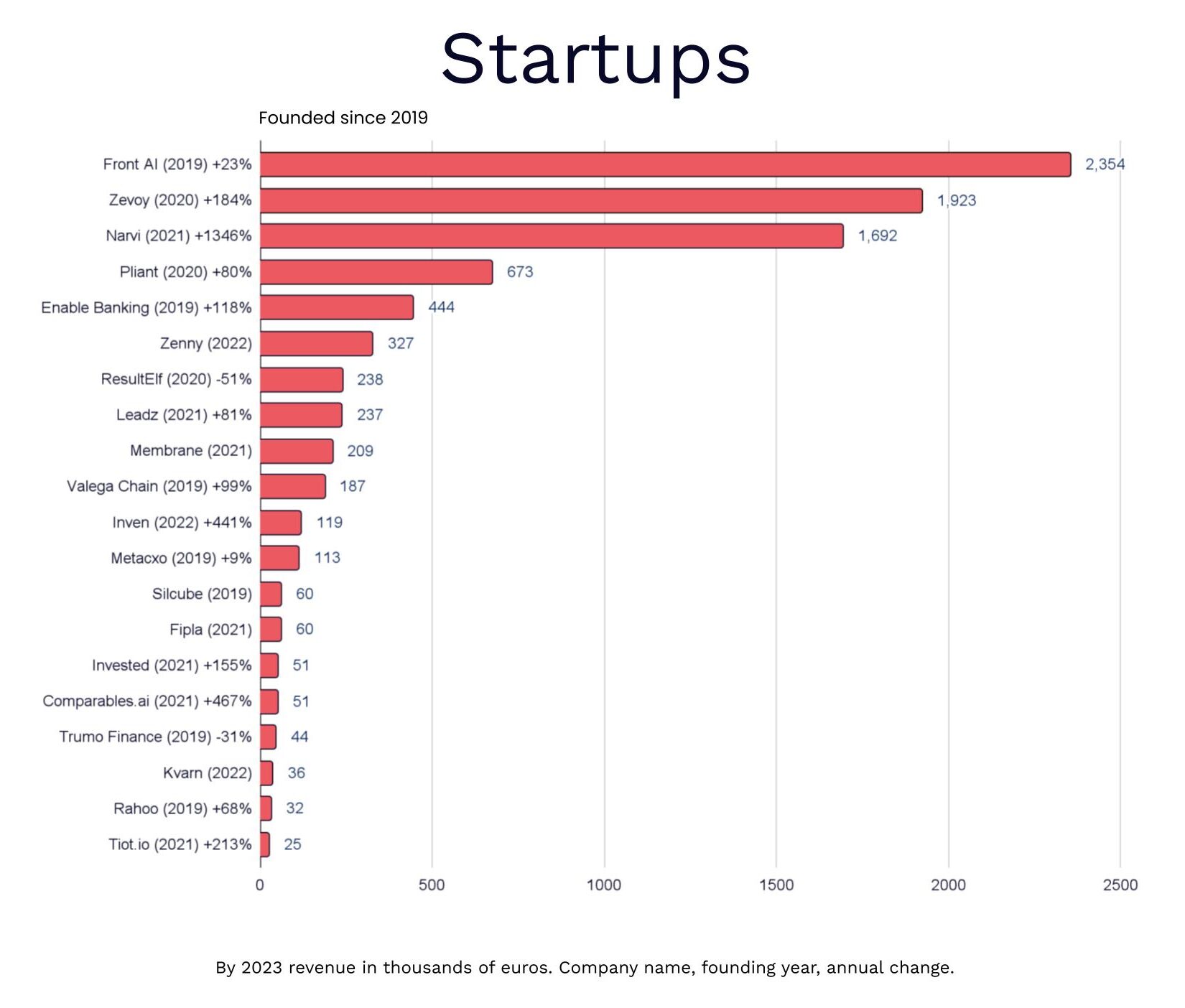

Startups – Companies founded in 2019 or later

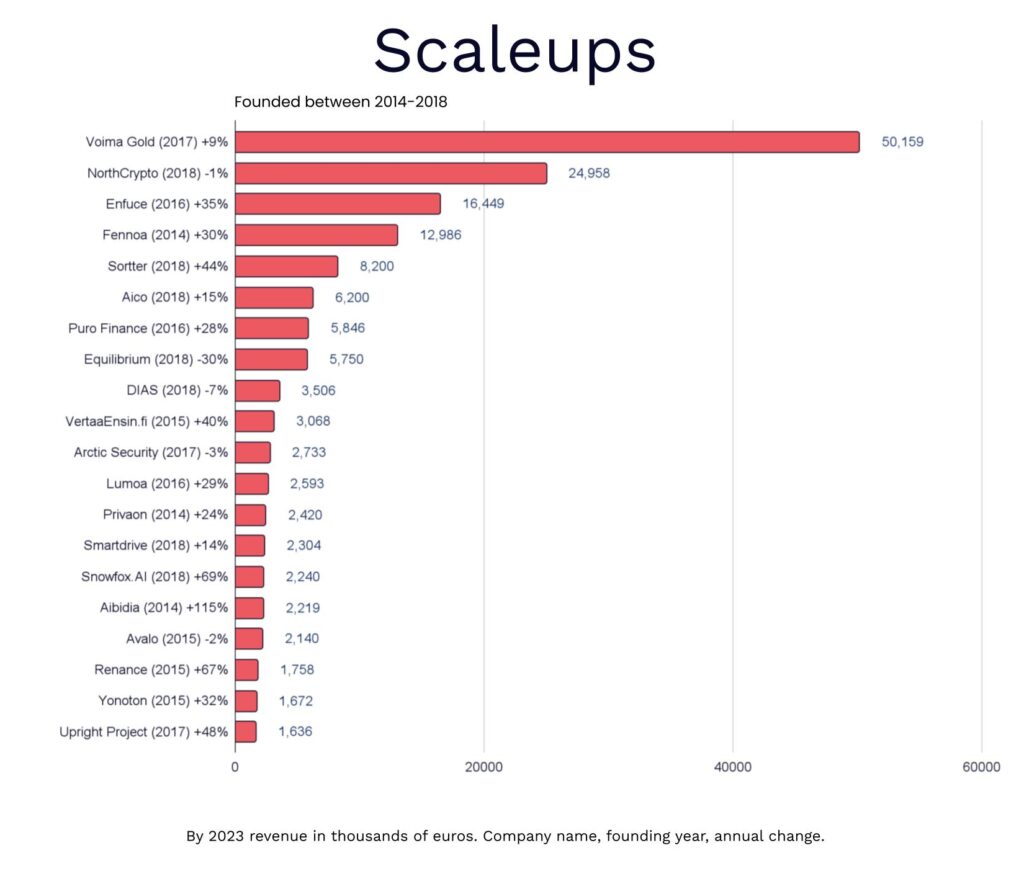

Scaleups – Companies founded between 2014 and 2018

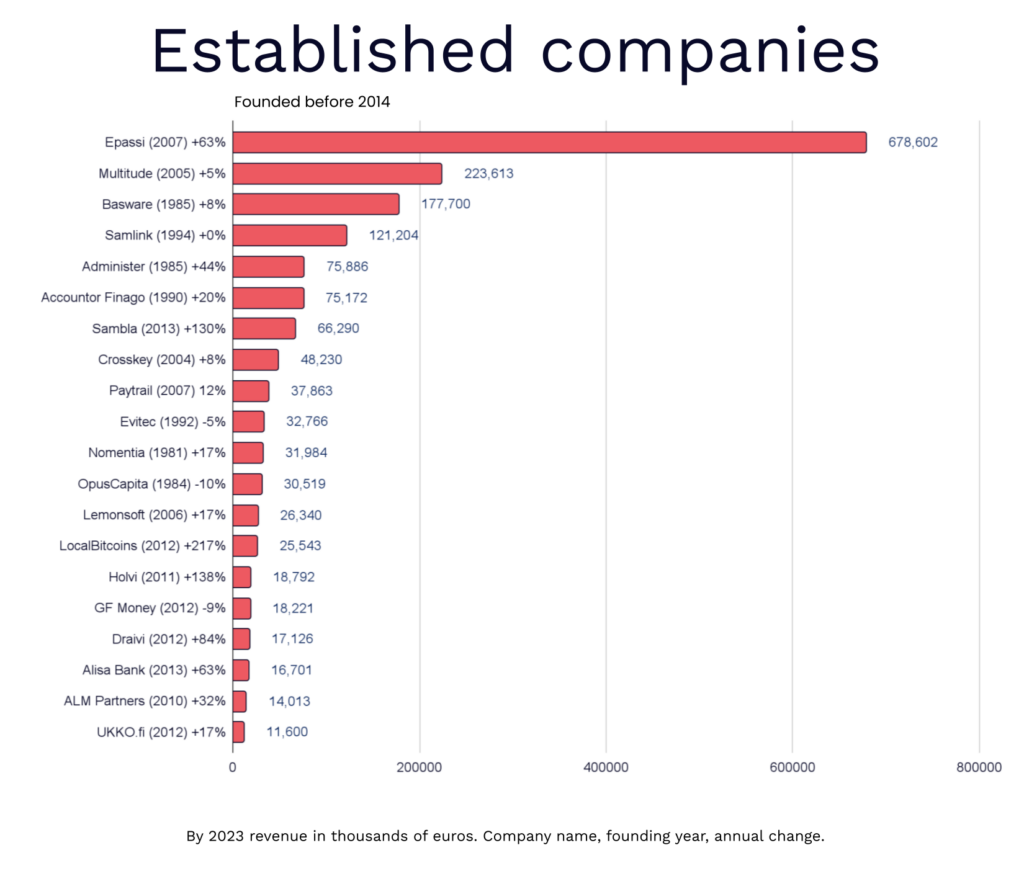

Established Companies – Companies founded before 2014

Top 20 Fintech Startups

In this category, we see several impressive success stories. Leading the pack is not that surprisingly an AI company, Front AI, which powers conversational AI solutions for multiple banks. Companies like Zevoy and Pliant, which provide payment cards and expense management solutions for businesses, are also demonstrating solid growth, while Narvi, a business account provider, stands out with an extraordinary 1346% growth rate.

However, it’s important to note that while some companies are already achieving impressive numbers, many are still in the early stages of their journey, with more modest financial figures.

Top 20 Fintech Scaleups

Among the scaleups, Voima Gold leads the way, although it’s worth noting that they count their customers’ investments as revenue, while their actual margin is around 3%. NorthCrypto, having recently moved from the startup category to scaleup, secured second place, despite its revenue remaining largely stable.

The growth rates of companies like Enfuce and Fennoa have slowed slightly but still hover around a solid 30%. Meanwhile, financial software and accounting tech companies such as Snowfox.AI, Aibidia, and Renance are some of the fastest-growing in this category. Tesseract Group, which reported nearly 16 million in revenue in 2022, has not yet filed its 2023 numbers.

Top 20 Established Fintech Companies

Among the established companies, Epassi continues its impressive growth trajectory, especially following its acquisition of competitors in 2024. It’s important to note that Epassi’s revenue includes all money charged to customers’ wallets, with around 96% of this being passed on to merchants.

Nearly all of Finland’s fintech “dinosaurs” reported growth in 2023, with Administer showing a particularly notable increase of 43%, partly due to their M&A activities in late 2022. Holvi, founded in 2012, has also made a significant leap in both revenue and profitability after shifting its focus away from free accounts to more sustainable business models.

Sambla Group is a new name on the list, formed from the merger of well-known broker companies LVS Brokers, Eone, and Salus Group, creating a stronger presence in the market.

Industry Outlook

The Finnish fintech industry is showing healthy development, focusing on quality over quantity. Of the 78 companies that reported revenue for both 2022 and 2023, 46 saw an increase, while 32 experienced a decrease.

- AI Integration: While we’re not seeing a wave of new AI-only fintechs, many companies are applying AI to enhance their existing services, which is a promising trend.

- Financial Software: Niche solutions for certain underserved categories such as SME services are growing rapidly and delivering profitable results.

- Consolidation: Especially in segments like payments, larger platforms are increasingly dominating the market.

Learn more

Do you want to know more about the Finnish or Nordic fintech industry? Do you need insights or help with your business? Please get in touch with us.

Fintech Farm

Fintech Farm is a financial technology hub and a digital finance service company connecting banks, fintech companies and service providers. Fintech Farm provides innovation, consulting, acceleration, matchmaking, and training services for the financial industry. Fintech Farm Ltd. is privately held and has built a vibrant community of over 200 financial industry organizations since 2016.

Fintech Database

Do you want to know more about Finnish fintechs? We have an up-to-date database that keeps on growing with over 20 data points. Visit the tasting version at https://www.helsinkifintech.fi/database/ and ask for subscription options to get full access.