This article was originally posted as a part of Helsinki Fintech Guide 2021 on June 23rd, 2021. You can download the full publication over here.

Teppo Havo, Nordic Head of Danske Bank Growth, tells us about Danske Bank’s role in the fintech ecosystem and about Danske Bank’s ambitious program to recruit and educate new angel investors.

Danske Bank in the fintech arena

One major area of development for banks is of course open banking. While the open interfaces were published some time ago, there is still much left to improve and develop. As a bank, we must be able to offer basic-level open banking and interfaces reliably and without disruptions, that is our absolute priority. One of the other priorities are premium API:s, or customised application programming interfaces. We want to make sure that the companies that are using our interface solutions can manage their business as seamlessly as possible.

This is a great opportunity for fintech start-ups. The market is still largely untapped and sustainability is an integral part of future business-to-consumer solutions.

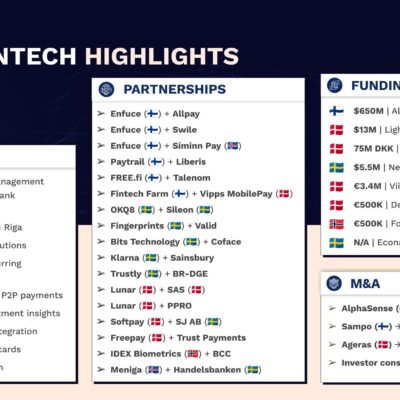

The current epidemiological situation has affected our fintech partnerships’ prioritisation and management. We have focused primarily on existing partnerships and a more restricted integration of ongoing projects. We have seen much fewer new partnerships than before the pandemic. Right now, we are working on a new fintech strategy and we hope to get back up to speed as soon as possible. Some examples of our existing fintech partnerships are: Aiia (Nordic API Gateway), Minna Technologies, Axeptia and Zenegy.

All four of these are Nordic-level partnerships and we have an equity stake in each of them. Digital Home Sale DIAS Oy is a digital home trading platform for the residential real estate market connecting buyers, sellers, real estate agents and banks. DIAS is based on distributed ledger technology (DLT.)

Danske and other banks participate in the project through a joint venture with founder Tomorrow Tech Oy. Tomorrow Tech recently sold its share to Alma Talent, but this is a good example of collaboration in the Finnish fintech sector. Danske’s growth business segment generally is all about making it possible for growth companies to succeed by offering working capital and creating optimal financing solutions in support of equity funding rounds.

On the other hand, we need fintech companies to support us in ecosystem building. Faster development of new products and services is a part of it, as are complementary business models.

The Finnish fintech sector

There is plenty of financing available on the international markets regardless of the vertical. Mostly landing a large funding round is a question of maturity; Finnish fintech companies are mainly still comparatively young and generally haven’t yet reached the milestones that big funding rounds require. But I think it is just a matter of time until we see more of them in the Finnish fintech sector!

The Finnish fintech sector is full of unrealised potential and the field is relatively very young. Some other sectors have witnessed founders doing exits with their start-ups and then going on to successfully found new start-ups in the same field. That is exactly what the Finnish fintech sector needs: Experienced entrepreneurs developing new businesses, making big breakthroughs with the help of big funding rounds.

ESG ans sustainability

Sustainability is a major driver for the banking sector today, and something that fintech companies need to be aware of. The Sustainable Finance Action Plan (SFAP) is a major policy objective by the European Union which aims to promote sustainable investment across the 27-nation bloc. The project will introduce a broad set of new and enhanced regulations that will define the reporting requirements of banks and big businesses regarding ESG. Taken as a whole, it will be a major influence on the finance sector. The project will have repercussions for the whole corporate sphere and corporate finance at least on a mid-term perspective.

When banks are faced with ESG compliance requirements, they will respond by making similar requirements for their customers. ESG compliance will become an inseparable part of corporate banking relationships in the long run.

This is a great opportunity for fintech start-ups. The market is still largely untapped and sustainability is an integral part of future business-to-consumer solutions. Fintech and other start-ups need to pay close attention to this also because the theme is so dominant in the finance sector. They need to assess whether their current business fits in the coming ESG environment, whether their current products have new applications in it, and whether they need to pivot from what they are currently doing in order to fit into ESG requirements.

TEPPO HAVO

Nordic Head of Danske Bank Growth

Teppo Havo has 14 years of experience in the banking sector and at Danske bank. During the last four years Teppo has focused all his efforts on the growth business segment, on startups, scale-ups and scalers in Finland and the Nordic countries. During that time he and his colleagues have built up a new business model for the growth sector. As part of that project, he has also been responsible for cooperation with the different players in the Finnish fintech sector. In 2021 he was named head of the Nordic growth business segment.

DANSKE BANK’S HUB INVEST PROGRAM – AN ANGEL BOOTCAMP WHY HUB INVEST?

Hub Invest is an incentive of Danske Bank in the Nordics, meant primarily to support early stage, pre-seed start-ups. For banks, financing very early-stage growth companies is challenging because of high risk levels. We wanted to complement our service offering to this segment and find ways to serve them better. We already had the The Hub https:// thehub.io/ service, a free-of-charge community platform where start-ups can get assistance with their recruitment of talent as well as connection with investors. In addition to this, we wanted an even more concrete way of helping early-stage start-ups connect with investors within a centralised framework. That was our starting point when we started working on Hub Invest in 2018.