By Karli Kalpala, Head of Strategic Transformation & Financial Services Industry at Digital Workforce

In the banking and insurance sectors, large-scale information processing has served as an ideal foundation for automation. Within these organizations, automation has rapidly gained ground, with some initiatives moving close to achieving straight-through processing and reducing the need for manual intervention.

Banks, in particular, have succeeded in significantly boosting their efficiency. The downside, however, has been a decrease in customer satisfaction with the loss of personalized service.

WHAT IS BUSINESS PROCESS AUTOMATION

– A LONG WAITED SHIFT FROM TACTICAL TO STRATEGIC AUTOMATION?

More recently, new technology-based opportunities have emerged for financial institutions to improve customer connections. Solutions that blend the remaining human activities with diverse automation technologies, intelligent orchestration, and efficient data management can leverage the expanding pool of customer data, opening a gateway to cost-effective customer experience enhancement and means to provide personalized services.

A technology term that often comes up in the above-described context is Business Process Automation (BPA). BPA tools enable businesses to plan and automate their complex business processes by building a dynamic technology environment based on value-added knowledge work.

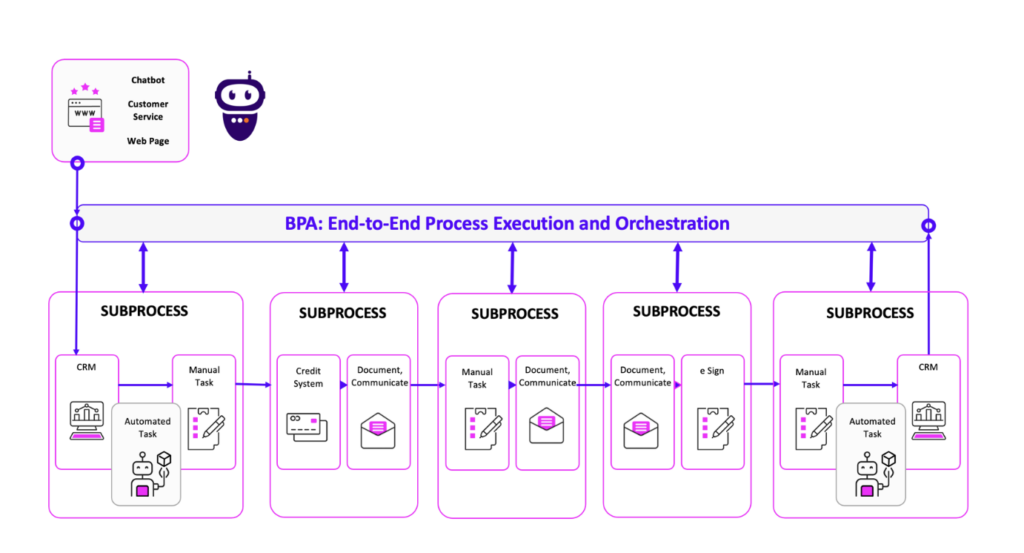

In short, BPA orchestrates business processes and automates tasks within them. It also simplifies the user experience for human workers that perform the remaining manual parts of processes. Solutions involving BPA can efficiently oversee and coordinate an entire process, integrating manual and automated tasks into one seamless workflow.

The key differentiator of BPA tools is that they provide features for managing the complete lifecycle of business processes:

- Discovering new improvement opportunities

- Modelling & redesigning processes

- Executing and Orchestrating processes

- Monitoring metrics

- Creating dashboards and analytics

- Identifying new opportunities

Figure 1: The image above represents how BPA links automated and manual tasks into one, orchestrating and managing an entire end-to-end process.

VALUE IN REAL LIFE

After introducing a more technical perspective, we will next provide an example illustrating how BPA can enhance the capabilities of other intelligent automation tools, turning them into strategic solutions encompassing the full spectrum of a business’s core operations.

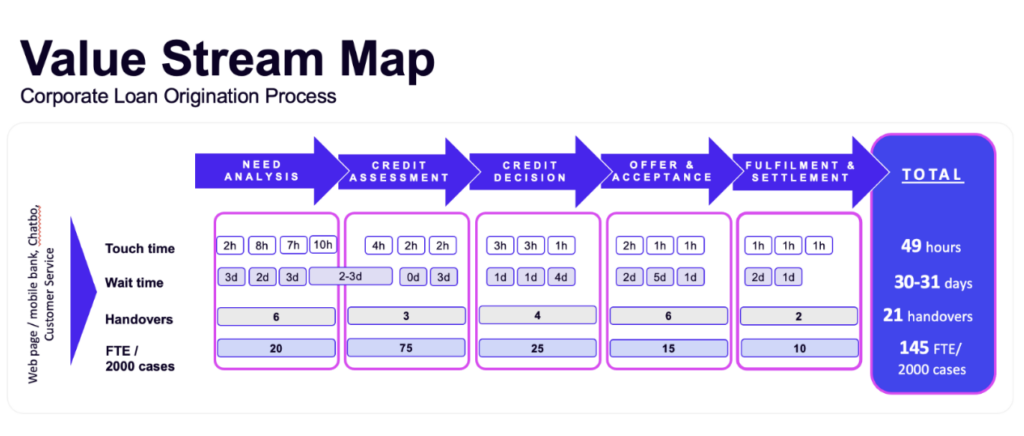

Figure 2: In the example, showcased in the image above, a bank receives a loan request. The loan request instigates a process involving 5 work phases or sub-processes and 21 handovers. The total touch time from the initial customer contact to loan payment takes about 49 hours of work but the wait time for the customer is more than 30 days.

The loan origination process encompasses both customer-facing and support tasks. While some of these tasks can be automated using tools such as Chatbots, Intelligent Document Processing, Robotic Process Automation, and Low Code Applications, manual work is also involved. In the traditional model, the workflow is often disrupted, and case data doesn’t proficiently travel along the customer journey. In this model, achieving straight-through processing is impossible, and every loan travels a unique path.

Business Process Automation (BPA) can oversee and manage the entire loan origination process, in effect, digitizing the customer journey. The solution enables seamless coordination and monitoring of individual case journeys while providing an overview of the full process by integrating data from various activities. The result is a digital audit trail for the entire loan origination process, elevating compliance to a new level and improving key performance indicators (KPIs) related to operational costs, accuracy on the first attempt, and turnaround times.

Achieved benefits in the example case of Figure 2:

- Seamless Digital Customer Journey:

Complete digitization of the customer experience. - Real-Time Data Accessibility:

Instant access to loan status to all stakeholders. - Cost-Effective Personalization:

Enablement of cost-effective personalized services & tracking of individual cases. - Swift Turnaround Times:

Significant reduction in process completion times. - Optimized Human Resource Utilization:

Improved manual work efficiency & simplified UX for human employees. - End-to-End Audit Trail:

Full transparency, and data visibility for compliancy & operational enhancements.

IN SUMMARY

Banks have more customer data than ever, but many customers feel unrecognized and underserved. Several reports clearly outline significant dissatisfaction from retail clients about how well they perceive they are being recognized, understood, and subject to being presented with relevant and individualized propositions from their banks.

In many cases, providing individualized service is inhibited by poor access to relevant client data and a drive to be highly efficient in serving large volumes of customers. BPA solutions offer cost-efficient means for banks and other financial institutions to provide individualized service, enhance customer experience, and gain complete control over their core operations.

BPA solutions are designed for tackling large process entities and solving core business problems.

Examples of topics addressed by BPA solutions:

- How can I provide a completely digital service experience for my customers?

- How can I better understand my clients and their needs based on previous behavior, information searched and risk profiling vs. holdings and forecasted economic conditions?

- How can I improve my communication with clients and make them more engaged, hence more likely to increase wallet share?

- How can I reduce lead time in acquisitions of new clients?

- How can I improve speed and accuracy in discrete and customized offerings to my clients?

We dare to claim that the future of banking and insurance lies in intelligent business automation that combines data analytics and process flows to deliver enhanced customer experiences and increased revenue.

Join our keynote at the Nordic Banking Forum to hear more and see if you agree!

Nordic Banking Forum Oct 11th, 11:20 am

Karli Kalpala, Head of Strategic Transformation & Financial Services Industry at Digital Workforce

3x Productivity: Freeing Customer-Oriented Innovation from Legacy Constraints

AUTHOR

Karli stands among the most senior experts in strategic business process automation within the Nordics. He has worked in the industry since its inception and has a further background in strategy consultancy within the Financial sector. Pulling from his extensive experience, Karli holds today the position of Head of Strategic Transformation at Digital Workforce – an industry-leading service provider in hyper-automation.

DIGITAL WORKFORCE